True Sale? Or Not True Sale? That is the Question

March 8, 2022

Within the past 18 months, two bankruptcy courts have used the same factors, but reached opposite conclusions, about the characterization of two merchant cash advance funding transactions as either a “true sale” or not a “true sale” – and instead, a disguised financing. In doing so, the courts’ decisions confirm the importance of appropriate structuring to achieve true sale treatment.

The characterization of a transaction as either a true sale or a disguised financing has significant implications for tax, accounting, and bankruptcy purposes. In the context of a bankruptcy proceeding, the characterization of a transaction determines whether the assets at issue are properly included within a debtor’s bankruptcy estate and subject to the automatic stay. Specifically, if a transaction is characterized as a true sale, the assets purchased would not be property of the debtor/seller’s bankruptcy estate, and would not be subject to the automatic stay. If, however, a transaction is characterized as a secured loan, the assets at issue would be considered merely pledged by the debtor/seller, would be property of the debtor/seller’s bankruptcy estate, and would be subject to the automatic stay. This is the precise issue considered by the bankruptcy courts in Cap Call, LLC v. Foster, Case No. 15-60979 (Bankr. D. Mont. Sept. 10, 2021) (“Shoot The Moon”) and In re R&J Pizza Corp., Case No. 14-43066 (Bankr. E.D.N.Y. Oct. 14, 2020) (“R&J Pizza Corp”).

The “true sale” analysis engaged in by these two bankruptcy courts, described in greater detail below, reminds practitioners of the following key structuring considerations:

- Do not rely solely on descriptions in the transaction documents of the parties’ “intent” to effectuate a sale rather than a secured loan. If the underlying facts and circumstances do not match these descriptions, courts may hold that these “self-serving” descriptions are not dispositive.

- Examine the allocation of risk as between the seller and the buyer. Generally, if the credit recourse is allocated to the seller or any guarantors, there is a greater likelihood that a court will recharacterize the transaction as a secured loan, regardless of the parties’ stated intent.

- To the extent possible, limit recourse, though representations and warranties concerning the facts at the time of a sale are appropriate.

- Avoid broad granting clauses that convey a “security interest” in the seller’s assets other than those being sold. Instead, grant only a protective security interest in the assets being sold.

- To the extent possible, limit or prohibit repurchase rights.

- Identify the parties as “seller” and “buyer” (not “lender” and “borrower”/“debtor”) in the transaction documents including, if the filing jurisdiction permits, in the UCC-1. Avoid using terms more appropriate for a secured loan rather than a sale.

- If the seller retains servicing obligations with respect to the purchased receivables, to the extent possible limit the commingling of collections on the purchased receivables with other collections.

Generally, to determine whether a transaction is a true sale or a pledge of assets securing a loan, most courts purport to look to applicable state law. Although courts often note the importance of applicable state law, courts have developed and apply a multi-factor test as a matter of federal common law. Because of the fact-intensive nature of the inquiry, no one factor of the test is dispositive, and the relative significance accorded to a particular factor varies significantly from case to case. If most of the relevant factors are present, however, recharacterization of a transfer of assets as a pledge, and the attendant inclusion of such assets in the seller’s bankruptcy estate and application of Article 9 duties, probably will result.

Courts have often identified the following eight factors as potentially relevant to a true sale recharacterization analysis:

- Language in the documents and conduct of the parties;

- Recourse to the seller;

- Seller’s retention of servicing/commingling of proceeds;

- Purchaser’s failure to investigate the creditor of the account debtor;

- Seller’s right to any excess collections;

- Purchaser’s right to unilaterally alter pricing terms;

- Seller’s right to unilaterally alter or compromise the terms of the underlying asset; and

- Seller’s retention of the right to repurchase.

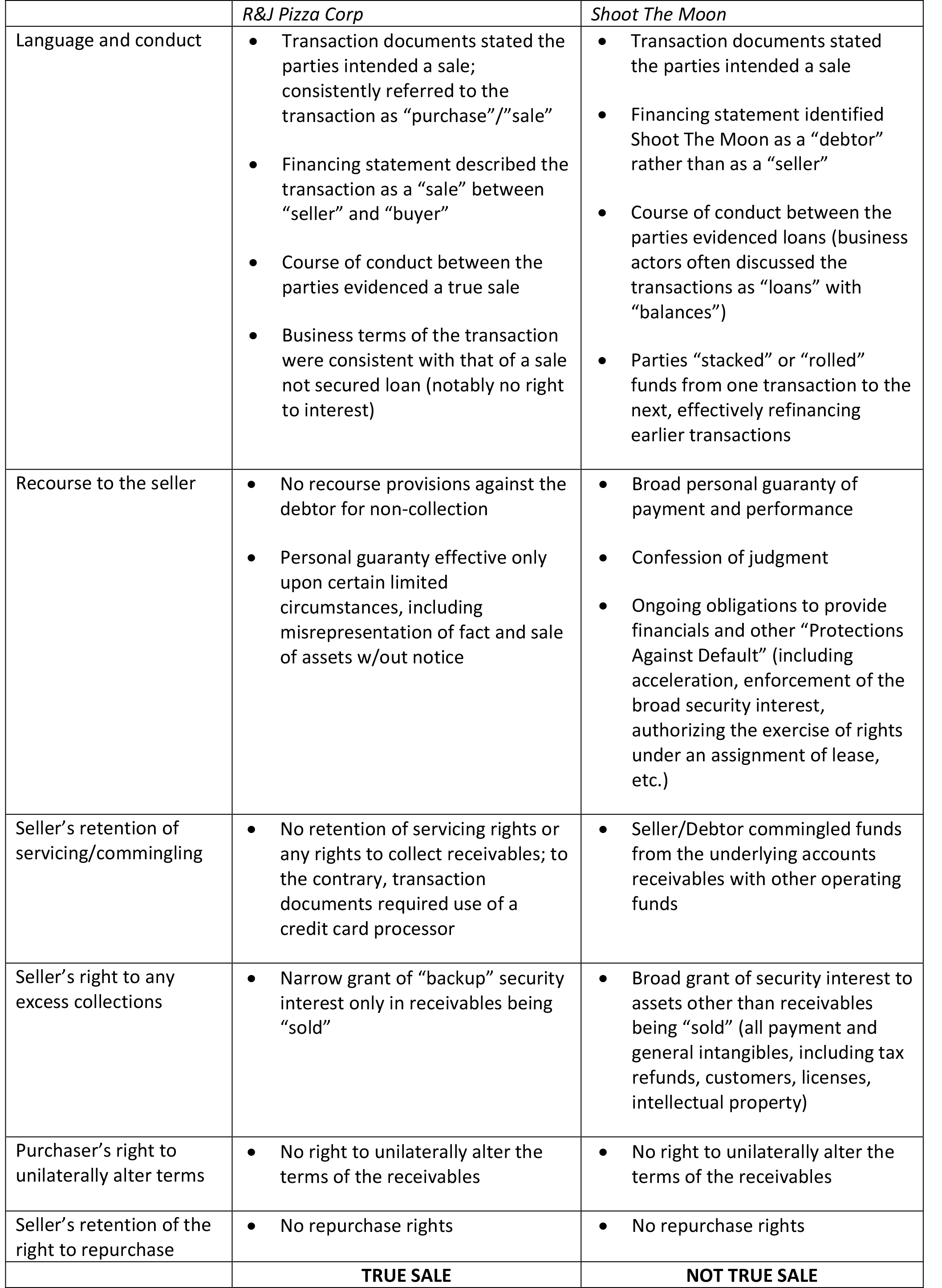

The bankruptcy courts in R&J Pizza Corp and Shoot The Moon applied these factors, and each focused on the same six (out of eight) factors identified in the following chart, which includes facts the courts discussed when analyzing these six factors:

After a review of the factors identified in the chart, it should be no surprise that the court in R&J Pizza Corp determined that transaction was a true sale, while the court in Shoot The Moon determined that transaction was a disguised financing. Specifically, while each of the six factors in the chart weigh in favor of a true sale determination in R&J Pizza Corp, the first four factors in the chart weigh in favor of recharacterizing the transaction as a secured loan in Shoot The Moon.

Although no one factor controls, both bankruptcy courts gave great weight to factors 1 (language and conduct), 2 (recourse to the seller), and 5 (seller’s right to excess collections), focusing on the overall nature of the transaction to determine the actual intent of the parties rather than the intent of the parties as stated in the documents.

In light of the relevant facts and circumstances, the conclusions reached by the two bankruptcy courts are not surprising. The two decisions, however, are good reminders of important considerations when structuring a transaction to achieve true sale treatment.