Treasury Guidance on Tax Credit Transfers

June 16, 2023

On June 14, 2022, the Department of the Treasury (“Treasury”) and the Internal Revenue Service (“IRS”) issued (1) proposed regulations regarding the election to transfer (sell) specified tax credits under Section 6418 of the Internal Revenue Code of 1986 (the “Code”),1 and (2) temporary regulations regarding the applicable pre-filing registration requirements for such transfers. The IRS also posted Frequently Asked Questions (FAQs) regarding transfers of tax credits.

The proposed regulations provide much-awaited guidance to taxpayers that have been waiting to execute or close on tax credit transfer transactions. While the proposed regulations answer many outstanding questions, Treasury and the IRS note several issues that are not addressed in the proposed regulations and where additional comments and recommendations are requested.

Section 6418 Proposed Regulations

The Inflation Reduction Act of 2022 added Section 6418 to the Code to permit “eligible taxpayers” (transferors) to elect to transfer specific tax credits to unrelated taxpayers (transferees) in exchange for cash.

The tax credits that may be transferred include the credits under Section 30C (alternative fuel vehicle refueling property), Section 45 (renewable electricity production), Section 45Q (carbon oxide sequestration), Section 45U (zero-emission nuclear power production), Section 45V (clean hydrogen production), Section 45X (advance manufacturing production), Section 45Y (clean electricity production), Section 45Z (clean fuel production), Section 48 (energy investment), Section 48C (qualifying advanced energy project investment) and Section 48E (clean electricity investment).

Selected guidance provided in the proposed regulations is described below:

Eligible Taxpayer – The proposed regulations define an “eligible taxpayer” as any person subject to any internal revenue tax, and other than one described in Section 6417(d)(1)(A), i.e., a tax-exempt entity, governmental entity, etc.

Eligible Credit – The tax credits listed above that an eligible taxpayer may elect to transfer include any bonus credit amounts with respect to that particular “single eligible credit property.” However, an eligible taxpayer is not permitted to transfer only the “bonus” credit amount separately from the “base” credit amount. Rather, the portion of the credit must reflect a proportionate share of each “bonus” credit amount that is taken into account in calculating the entire amount of the credit for the property. In addition, eligible credits do not include any tax credit carryforwards or carrybacks under Section 39. Similarly, no election is permitted for eligible credits based on qualified progress expenditures.

The proposed regulations clarify that the amount of the eligible credit that can be transferred may be limited by other rules that relate to the determination of an eligible credit, such as the at-risk and tax-exempt use property rules. For partnerships and S corporations, these rules are applied at the partner or shareholder level.

A transferee would apply rules that relate to the amount of a transferred credit that is allowed to be claimed based on the transferee’s particular tax circumstances, such as the rules in Section 38 (business tax credits) or Section 469 (passive activity loss rules). Accordingly, a transferee taxpayer subject to the passive activity loss rules (e.g., individuals who do not materially participate in the activity) is required to treat credits in excess of its passive tax liability as passive activity credits. At the same time, the proposed regulations confirm that an eligible credit will not lose its status as generated in a trade or business (of the transferor), and the credit will not be disallowed under Section 38 because the credit is transferred to an individual.

Eligible Credit Property – “Eligible credit property” is defined as the unit of property of an eligible taxpayer which respect to which the amount of an eligible credit is determined, and is determined with respect to each “single eligible credit property” of the eligible taxpayer.

The proposed regulations provide that the appropriate unit of measurement for Section 6418 registrations and elections for each eligible credit is determined by reference to the statutory rules for each credit. Accordingly, for the tax credits under Sections 45, 45U, 45V, 45X, 45Y, 45Z and 48E (for a qualified facility), a taxpayer is required to register and make an election on a “facility-by-facility” basis for each relevant “qualified facility” as defined in those Sections. For example, with respect to a wind project, the registration and election must be made for each wind turbine. See Rev. Rul. 94-31. For the tax credits under Section 30C, 48, 48C and 48I (units of energy storage technology), a taxpayer is required to register and make an election on a property-by-property basis as the relevant “property” is defined in those Sections.

The preamble describes a special rule for Section 48 energy property and states that such property “generally includes all components of property that are functionally interdependent”—that is, the placement into service of each component is dependent on the placing in service of other components in order to generate electricity. This language suggests that each “block” or “phase” of a large solar project would be a separate energy property as each block or phase can “begin producing electricity separately from other components of property within a larger energy project.”

With respect to the Section 48 credit, an eligible taxpayer has the option to make the Section 6418 registrations and election for an “energy project” as defined in Section 48(a)(9)(A)(ii) (“a project consisting of one or more energy properties that are part of a single project”) and in forthcoming guidance. For the tax credit under Section 45Q, a taxpayer would be required to register and make an election based on a unit of carbon capture equipment (i.e., each single process train).

“Paid in Cash” – Any amounts paid by a transferee taxpayer in connection with the transfer of an eligible credit must be “paid in cash.” The proposed regulations provide that paid in cash means in United States dollars and permits payment by cash, check, cashier’s check, money order, wire transfer, ACH transfer or other bank transfer of immediately available funds.

The payment in cash requirement is satisfied if cash payment is made within the period beginning on the first day of the transferor’s taxable year during which a specified credit portion is determined and ending on the due date for completing a transfer election statement (i.e., the earlier of the filing of the relevant transferor or transferee return).

Importantly, the proposed regulations specifically permit “advanced commitments” that provide that a contractual commitment to purchase eligible credits in advance of the date an eligible credit is transferred—provided that all cash payments are made during the specified time period described above. This item was raised in a number of stakeholder comments and is important to upfront payments typical in production tax credit transactions.

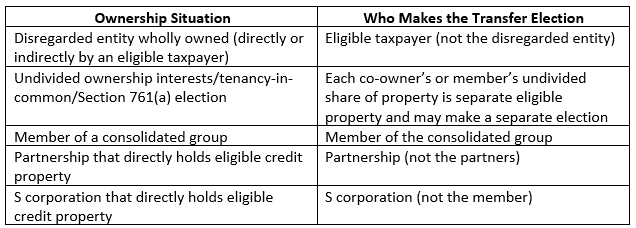

Special Ownership Situations – The proposed regulations provide rules for different ownership situations to determine the eligible taxpayer that is permitted to make a transfer election.

The proposed regulations provide that no transfer election is permitted if the eligible credits are not determined with respect to an eligible taxpayer (i.e., through ownership of the property or conducting the activity that gives rise to the tax credit).

Transfer Election – An election must be made for each “single eligible credit property” and may not be made separately with respect to the base and bonus credits. However, the proposed regulations confirm that a taxpayer may retain a portion of the credit and transfer the balance. The proposed regulations also confirm that a taxpayer may make multiple transfer elections to transfer portions of the credit available for a property to multiple transferees as long as the aggregate amount of credits does not exceed the credits available for that property. In the case of credits that are claimed over several years, a transfer election must be made for the eligible credit property for each taxable year the eligible taxpayer elects to transfer some or all of the credits.

An eligible taxpayer can make a transfer election by filing a tax return that includes: (1) the relevant form applicable to the eligible credit (e.g., Form 3468 for certain investment tax credits); (2) Form 3800 (General Business Credit), including the registration number and attaching a schedule showing the amount of credit transferred for each property; (3) a “transfer election statement” between the parties (as described below); and (4) any other information specified in IRS guidance. On the transferee side, the transferee is required to include the following with its tax return claiming the transferred tax credits: (1) Form 3800 taking into account a transferred credit as a current general business credit, including all registration numbers related to the transferred credit; (2) the transfer election statement between the parties; and (3) any other information specified in IRS guidance.

Registration – Taxpayers are required to register before filing the tax return on which a transfer election is made and provide certain information related to each property for which a transfer election is contemplated. After the pre-filing registration is complete, the taxpayer will receive a unique registration number for each property. The registration number is valid only for the taxable year for which it is obtained and must be renewed for subsequent years. In addition, if the facts regarding the property change the registration must be amended. The pre-filing registration process is further described below.

Transfer Election Statement – A “transfer election statement” is a written document that describes the transfer of a specified credit portion between the transferor and transferee, and which must be attached to the relevant transferor and transferee tax returns. The transfer election statement is similar to the procedures for lease credit pass-through election statements under Treas. Reg. 1.48-4. Importantly, however, the proposed regulations impose a “required minimum documentation” requirement. The proposed regulations require that the transferor state or represent in the transfer election statement that the transferor has provided the transferee the “required minimum documentation” which includes: (1) information that validate that the project exists as prepared by a third-party; (2) if applicable, documentation substantiating any bonus credit amounts (e.g., in the case of Section 45 credits, the prevailing wage and apprenticeship multiplier, domestic content bonus and energy community bonus); and (3) evidence of the qualifying costs in the case of an investment tax credit or the relevant production activities and sales amounts in the case of a production tax credit. The transferee is required to keep these records for as long as they are “material in the administration of any internal revenue law.”

Treatment of Payments – The proposed regulations provide rules that clarify that the amounts paid by the transferee are not included in the gross income of the transferor and are not deductible by the transferee. The proposed regulations also include an anti-abuse rule that would disallow the election and transfer of credits if the parties engage in transaction(s) with the principal purpose of avoiding tax liability (e.g., decreasing taxable income or increasing deductions). In addition, Treasury and the IRS are still considering and requested comments on the tax treatment of transactions costs and whether a transferee may deduct a loss if the amount paid for the eligible credit exceeds the amount of the credit the transferee is actually able to claim.

The proposed regulations resolve a key issue raised by certain stakeholders regarding the tax treatment of any “discount” in the amount of the transferee’s payment versus the nominal amount of the credit. The proposed regulations clarify that a transferee does not have gross income if the amount paid for a credit is less than the amount of the credit transferred and claimed.

Timing Rules – The transfer election statement must be completed by the parties prior to the earlier of (a) the transferor’s filing of its tax return for the taxable year for which the tax credit is determined or (b) the transferee’s filing of its tax return for the year in which the transferred credit is taken into account. A transfer must be made not later than the due date for the tax return (including extensions) for the taxable year for which the credit is determined. An election cannot be made on a tax return amended after the filing deadline (including extensions). Finally, the proposed regulations provide that there is no relief available under Section 301.9100 of the Treasury Regulations for a late transfer election.

The transferee takes a credit into account in the first taxable year ending with or ending after the taxable year (of the transferor) with respect which the credit was determined. Accordingly, if the transferor and the transferee are both calendar year taxpayers, a credit generated in 2023 will be taken into account by the transferee for the 2023 tax year. A transferee taxpayer may also take into account an eligible credit that it has purchased, or intends to purchase, when calculating its estimated tax payments.

Transfer Limitations – Consistent with Section 6418, a transfer election is irrevocable, and second transfers of credits are prohibited. The preamble clarifies that “pooling” or dealer arrangements would violate the second transfer prohibition, but a broker arrangement matching potential buyers and sellers of credits is fine as long as the credits are not transferred to the broker—following general tax ownership principles. In proposed regulations under Section 6417 (the “direct payment” provisions), issued on the same date, Treasury and the IRS declined to adopt the comments offered by certain stakeholders that would have permitted transferees to “chain” an election under that provision with respect to purchased credits.

Partnerships – The proposed regulations provide rules related to the transfer of tax credits by transferor partnerships and the purchase of tax credits by transferee partnerships.2 Importantly, these rules permit transferor partnerships to determine the portion of each partner’s eligible credit amount to be transferred and provide that a partner’s distributable share of the tax exempt income resulting from the transferor partnership’s receipt of cash is allocated in the same proportion as the credit would have been allocated to such partner if the tax credit transfer had not occurred. In the case of a transfer of a portion (but not all) of the transferor partnership’s tax credits, the tax-exempt income is allocated to the partners whose share (or portion thereof) of the credits is transferred. The proposed regulations provide helpful examples of the application of this rule. In addition, the proposed regulations confirm that there are no restrictions on how a transferor partnership can use the cash received from the transfer—including how it makes distributions to its partners. Finally, the proposed regulations clarify that any tax exempt income resulting from the transfer consideration is treated as investment income (and not passive income) for partners who do not materially participate for purposes of the passive activity loss rules.

For transferee partnerships, the allocation of a transferred credit to its partners is not a violation of the “no second transfer” rule. However, the partner is not permitted to make a transfer election to transfer its allocated credits—a transfer of credits to the transferee partnership has already occurred. The cash payment is treated as a Section 705(a)(2)(B) expenditure of the transferee partnership and each partner’s distributive share is determined by the partnership agreement or, if not provided in the agreement, in accordance with the transferee partnership’s general allocation of nondeductible expenses. In addition, the purchased credits are treated as an extraordinary item under Treasury Regulations Section 1.706-4(e).

Transfer elections for the transferor partnership are as described above and would be attached to the partnership tax return and the deadline for filing the election is determined with respect to the partnership’s tax return.

Recapture – The proposed regulations provide that the recapture amount is calculated and taken into account by the transferee and the preamble clarifies that there is “no prohibition under section 6418 for an eligible taxpayer and a transferee taxpayer to contract between themselves for indemnification for the transferee taxpayer in the event of a recapture event.” Further details regarding the required “recapture notices” are detailed in the proposed regulations—with the transferee taxpayer taking into account the recapture amount in its tax filings and the transferor increasing its tax basis in the eligible credit property consistent with the rules under Section 50(c). The proposed regulations confirm that a recapture event will not be treated as an excessive credit transfer (i.e., trigger a penalty under those rules).

While Section 6418(g)(3) only references the recapture rules under Section 50(a) of the Code (that do not apply to Section 45Q), the proposed regulations require similar recapture rules if a recapture event described in Treasury Regulation Section 1.45Q-5 occurs.

Special recapture rules are provided for transferor partnerships. The proposed regulations provide that in the event of a reduction of a certain percentage of the partner’s interest in the partnership that would result in recapture to such partner, the reduction is not a recapture event for the transferee and no notice is required to be provided by the transferor to the transferee. Instead, any recapture liability (i.e., increase in tax) to the disposing partner is calculated in accordance with the tax credit recapture rules in accordance with Treasury Regulation Section 1.46-3(f) (i.e., with respect to the disposing partner).

Excessive Credit Transfers – The proposed regulations define an excessive credit transfer consistent with Section 6418(g)(2)(C) and the Joint Committee on Taxation description of the provision. An “excessive credit transfer” is an amount equal to the excess of (i) the amount of the credit claimed by the transferee with respect to the property over (ii) the amount of the credit that would be otherwise allowable with respect to the property in the hands of the transferor.

The 20% penalty for excessive credit transfers does not apply if the transferee demonstrates to the IRS’s satisfaction that it resulted from reasonable cause. This determination is based on relevant facts and circumstances and proposed regulations provide that facts and circumstances include, but are not limited to: (1) review of the transferor’s records regarding the determination of the credit; (2) reasonable reliance on third-party expert reports; (3) reasonable reliance on representations from the transferor that the total credit transferred does not exceed the total credit with respect to the property; and (4) review of audited financial statements provided to the Securities and Exchange Commission, if applicable. These rules are consistent with the reasonable cause rules generally applicable to penalties under the Code (see, e.g., Section 6664 and regulations thereunder), but the proposed regulations specifically describe the transferee’s reliance on the relevant credit information provided by the transferor as part of the transferee’s diligence process.

Three examples in the proposed regulations demonstrate when excess credit transfers occur. In general, these examples illustrate that an excessive credit transfer is determined by taking into account any amount of credit retained by the transferor and applying any disallowance to that retained portion first before concluding any excessive credit transfer.

REITs – Advice was requested from stakeholders with respect to various issues related to the transfer of credits by REITs. Treasury and the IRS declined to address these issues in the proposed regulations, but (1) requested comments if additional guidance is required with respect to REIT issues and (2) noted Treasury and the IRS do not believe that a prohibited transaction tax issue arises from the transfer of tax credits.

Effective Date – Taxpayers may rely on the proposed regulations for taxable years beginning after December 31, 2022, until the date the final regulations are published in the Federal Register, provided the taxpayers follow the proposed regulations in their entirety and in a consistent manner.

The transferability guidance was issued in the form of a notice of proposed rulemaking by Treasury and the IRS with accompanying proposed regulations—bypassing the normal process involving the IRS’s issuance of “sub-regulatory” guidance in the form of an IRS Notice. This form of guidance invokes formal regulatory procedures, including the submission of written public comments, which are due by August 14, 2023, and a public hearing, which is scheduled for August 23, 2023.

Pre-Filing Registration Temporary Regulations

The temporary regulations describe mandatory information and registration requirements for eligible taxpayers that elect to transfer eligible credits under Section 6418 (as well as providing consistent rules for making a “direct payment” election under Section 48D or Section 6417).

The temporary regulations applicable to Section 6418 provide the following pre-registration requirements:

- The taxpayer must complete the pre-filing registration process through an IRS electronic portal in accordance with the instruction to be provided.

- The taxpayer must satisfy the registration requirements and receive a registration number prior to making a transfer election. If no registration number is obtained, a transfer election will not be effective.

- The taxpayer is required to obtain a registration number for each property with respect to which a transfer election is made.

- The taxpayer must provide the specific information required to be provided as part of the pre-filing registration process.

The information required to complete the pre-filing registration:

- The taxpayer’s general information, including its name, address, taxpayer identification number, and type of entity.

- Any additional information required by the electronic portal (i.e., information that establishes that the entity is an “eligible taxpayer).”

- The taxpayer’s taxable year, as determined under Section 441.

- The type of annual tax return(s) normally filed by the taxpayer (or that the taxpayer does not normally file an annual tax return with the IRS.)

- The type of eligible credit(s) for which the taxpayer intends to make a transfer election.

- Each property that the taxpayer intends to use to determine a specified credit, portion for which the taxpayer intends to make a transfer election.

- For each such property, any further information required by the electronic portal (e.g., the type of property, its physical location, supporting documentation related to the construction or acquisition of the property, the beginning of construction and placed service date of the property, and any other information that the taxpayer believes will help the IRS evaluate the registration request).

- The name of a contact person for the taxpayer that possesses the legal power to bind the taxpayer or has a properly executed power of attorney on Form 2848.

- A penalties of perjury statement covering all information provided and signed by a person with personal knowledge of the information and authorized to bind the taxpayer.

- Any other information that the IRS deems necessary for preventing duplication, fraud, improper payment, or excessive payments as provided in guidance.

As noted above, the registration is only valid for the taxable year the credit is determined for the property and for a transferee’s taxable year in which the credit is taken into account. If credits will be claimed with respect to the taxable year after a registration number has been obtained, the registration must be renewed by the taxpayer, including attesting that no information has changed or if it has, updating the information. The information must also be updated if the information changes after issuance of the registration number, but prior to the use of the number.

IRS Review and Audit

One key area that remains unclear under the proposed and temporary regulations is the scope of the IRS pre-filing review process for eligible credit transfers and the IRS’s audit procedures following the filing of the relevant transferor and transferee tax returns and forms. The regulations indicate that registration is required before a transfer may be effective but the timing of the registration and the IRS’s discretion in providing a registration number is not clear. For example, if the transferor fails to provide sufficient information with the pre-filing registration, what procedures will the IRS follow in requesting additional information—as the italicized language earlier indicates this additional information may be “as provided in guidance.” In addition, although the proposed regulations indicate that the transferee is responsible for any excessive transfer payment, they do not provide details on the applicable audit procedures (e.g., whether deficiency procedures apply). Likewise, the proposed regulations do not specify whether the transferee, transferor or both parties are subject to audit. These issues were raised by stakeholders in comments but were not fully addressed.

Other Information

In the preamble to the temporary regulations, it appears that Treasury and the IRS plan to make the electronic portal available by the fall of this year.

The temporary regulations apply to taxable years ending on or after the temporary regulations are published in the Federal Register.

If you have any questions regarding the proposed regulations or temporary regulations or would like to submit comments to the regulations, please contact us.

1 Unless otherwise stated, Section references in this Client Alert are to the Code.

2 The proposed regulations also provide rules regarding S corporations. Those rules are not described in this alert.