IRS Notice 2021-41 Extends the Beginning of Construction Continuity Safe Harbor for Certain Renewable Energy Facilities

June 30, 2021

The Internal Revenue Service and Treasury Department have provided additional guidance to address the beginning of construction rules for wind, solar and other renewable energy projects to qualify for tax credits under Sections 45 and 48. To address the unforeseen interruptions developers are experiencing due to COVID-19, the Internal Revenue Service has issued Notice 2021-41 (the “Notice”), extending and modifying the “beginning of construction” requirements for both the Section 45 production tax credit (“PTC”) and the Section 48 energy investment tax credit (“ITC”). The Notice provides the following extensions and modifications:

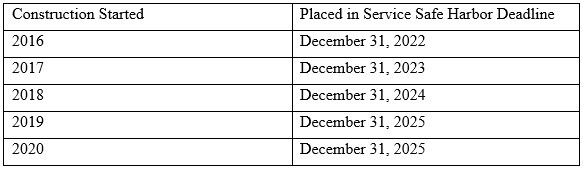

- For projects that started construction in calendar years 2016, 2017, 2018 and 2019, the continuity safe harbor provided under current IRS guidance is extended to six years, and for projects that started construction in 2020, the four-year continuity safe harbor provided under current IRS guidance is extended to five years:

Additionally, taxpayers that do not satisfy the continuity safe harbor are now permitted to use either continuous efforts or continuous construction on a facts and circumstances basis to satisfy the continuity requirement.

If you have any questions about this recent guidance, please reach out to a member of our renewable energy tax credit team.