SEC Proposes Sweeping Changes to Schedule 13D and Schedule 13G Reporting

April 4, 2022

What Happened:

On February 10, 2022, the Securities and Exchange Commission (SEC) voted 3 to 1 to propose for comment a large number of changes to the rules under the Securities Exchange Act of 1934 (Exchange Act) relating to Schedule 13D and Schedule 13G (Regulation 13D-G) in SEC Release No. 34-94211 (the Proposing Release).

The Bottom Line:

The SEC’s stated purpose for proposing a “comprehensive” set of changes to Regulation 13D-G is to “modernize the beneficial ownership reporting requirements and improve their operation and efficacy” and to address “information asymmetries.” If adopted, those changes will shorten the time allotted for preparing and making a Schedule 13D or Schedule 13G filing after the initial filing or amendment obligation is triggered and significantly accelerate the trigger events that give rise to a filing or amendment obligation. The proposal also changes a number of other important aspects of Regulation 13D-G, especially as related to group formation. This set of proposals should be considered in light of a number of other proposals to change the nature, and increase the extent and frequency, of existing reporting by large investors.1

The Full Story:

Proposed Changes relating to Schedule 13D

Interestingly, while much of the Proposing Release addresses the need to amend Schedule 13D in the context of contests for corporate control, the changes to the Schedule 13D rules are, in many ways, less significant than the changes to the Schedule 13G rules. Further, while the changes to the Schedule 13G rules are often targeted at investors that allegedly use Schedule 13G to skirt the more stringent Schedule 13D rules, the changes to the Schedule 13G rules would affect all Schedule 13G filers – not just those that frequently switch between filing Schedule 13G and filing a Schedule 13D.

As to Schedule 13D, the rules currently in effect require a Schedule 13D to be filed within 10 calendar days of a person acquiring beneficial ownership of more than 5% of a class of registered equity securities (equity securities). Because of the SEC’s concern that the current 10-day delay in a filing obligation allows investors to assemble large positions without timely reporting, the Proposing Release would reduce this time to 5 calendar days. Insofar as Schedule 13D amendments are concerned, the current requirement is that an amendment must be filed “promptly” after a material change in any facts previously reported. The Proposing Release would require that a Schedule 13D amendment be filed on the first business day after a material change.

Proposed Changes Relating to Schedule 13G

In terms of Schedule 13G reporting, the rules currently in effect contemplate quite different filing requirements depending on whether the filer is a Qualified Institutional Investor or an Exempt Investor, on the one hand, or a Passive Investor, on the other.

- The Qualified Institutional Investor category includes SEC-registered broker-dealers, SEC-registered investment advisers, certain banks, certain insurance companies, and certain other specified types of institutional and similar investors that acquire beneficial ownership of more than 5% of a class of equity securities in the ordinary course of business and without a control purpose.2

- The Exempt Investor category requires disclosure by beneficial owners of more than 5% of a class of equity securities that have not otherwise been reported (or been required to be reported) on a Schedule 13D or Schedule 13G; this covers a number of different fact patterns but in practice is used primarily by persons that acquired all their securities prior to the issuer registering a class of equity securities under Section 12(b) or 12(g) of the Exchange Act or that acquire not more than two percent of a covered class within a 12-month period prior to crossing the 5% threshold.

- Passive Investors are investors, other than Qualified Institutional Investors or Exempt Investors, that acquire beneficial ownership of more than 5% of a class of equity securities without a control purpose.

Under the current rules and subject to certain exceptions, neither a Qualified Institutional Investor nor an Exempt Investor is required to file an initial Schedule 13G report unless it beneficially owns more than 5% of the class outstanding as of December 31 of the year in which it crossed that threshold; that initial Schedule 13G filing currently is due 45 calendar days after the end of such calendar year. On the other hand, a Passive Investor is currently required to file a Schedule 13G within 10 calendar days of acquiring beneficial ownership of more than 5% of the relevant class.

Under the Proposing Release, a Qualified Institutional Investor and an Exempt Investor each would be required to file a Schedule 13G no later than 5 business days after the end of the month in which it first beneficially owns more than 5% of the relevant class of equity securities. This filing deadline could potentially be more than a year earlier than required under the current rules. A Passive Investor would have to file its initial Schedule 13G no later than 5 calendar days after its beneficial ownership of equity securities exceeds 5% of the subject class (a relatively modest acceleration of the filing deadline). In effect, the Proposing Release would substantially reduce the delayed reporting benefits currently accorded Qualified Institutional Investors and Exempt Investors relative to Passive Investors.

The effect of the Proposing Release on the frequency and timing of filing Schedule 13G amendments is unclear. The existing amendment rule (Rule 13d-2(b)) provides that a reporting person “shall amend the statement within forty-five days after the end of each calendar year if, as of the end of the calendar year, there are any changes in the information reported in the previous filing” (emphasis added). Amendments are also required after a Qualified Institutional Investor or a Passive Investor acquires beneficial ownership of more than 10% of the class of securities and for subsequent increases or decreases of 5% (within 10 calendar days for the former and promptly for the latter). In effect, under the current reporting regime, once a Qualified Institutional Investor, Exempt Investor, or Passive Investor made its initial filing, no further evaluation was required until the end of the next calendar year or, if earlier, when the position first exceeds 10%.

However, the Proposing Release would require amendments to Schedule 13G be filed on a monthly basis – but only if there has been a “material” change. Such an amendment will be due 5 business days after the end of the month in which the change occurred. How this requirement will play out in practice is difficult to assess because there is no current common practice of applying a materiality standard in this context; there is no materiality component to the current amendment requirement for Schedule 13G. In addition, the SEC has not provided any guidance on this point.3

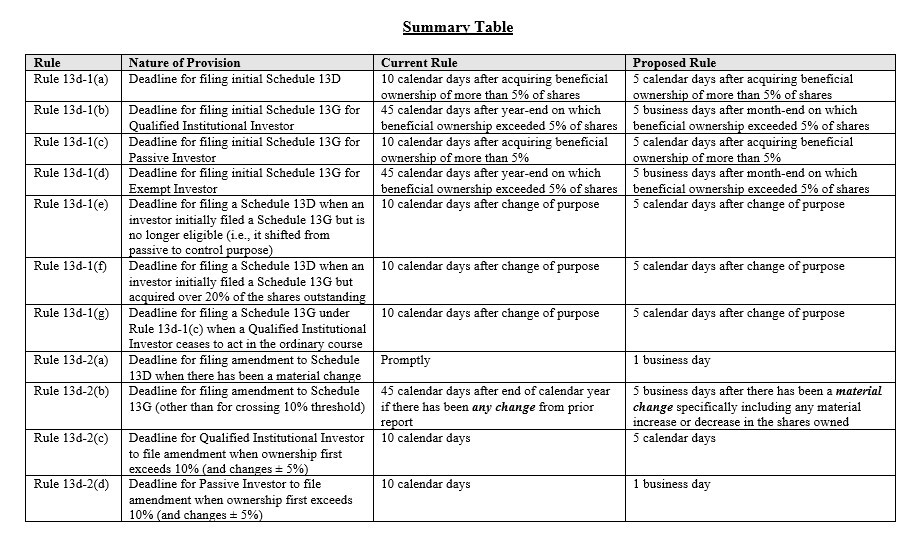

A tabular view of the changes described in this section is included at the end of this alert.

Proposed Changes relating to Swaps

Under the current rules, cash-settled derivatives are generally not thought to confer beneficial ownership of the referenced securities because the holder of a long cash-settled derivative does not have the right to acquire or vote such underlying shares.4 The Proposing Release expounds at length on the ways cash-settled derivatives could be or have been used (or misused) in connection with contests for corporate control and the need for reform. To address this issue, the SEC has proposed Rule 13d-3(e) which, for persons not eligible to file Schedule 13G due to a control purpose, for the first time would deem the shares referenced by such instruments to be beneficially owned for Section 13(d) reporting purposes. The rule also includes a detailed formula for calculating how many shares would be included for such purposes and how to calculate the shares outstanding in such situations.

However, the proposed changes to the treatment of derivatives in Rule 13d-3(e) exclude all security-based swaps. In practice, this should mean that Rule 13d-3(e) will come into play only if a person who is ineligible to file on Schedule 13G purchases cash-settled options (or other derivative instruments that are not considered security-based swaps). For security-based swap positions – whether or not held by persons who act with a control intention – reporting will be governed by proposed Schedule 10B and its implementing rules (if adopted).5

Proposed “Group” Changes

The current and proposed versions of Regulation 13D-G both contemplate that when investors form a “group,” the group is deemed to be the beneficial owner of the securities owned by the group’s members. However, the Proposing Release would adopt a number of changes to what constitutes a group under Regulation 13D-G:

- The Proposing Release would amend Rule 13d-5(b) by conforming the text “more closely” to the statutory language. The current rule provides (and has provided for more than 40 years) that “When two or more persons agree to act together for the purpose of acquiring, holding, voting or disposing of equity securities of an issuer, the group formed thereby shall be deemed to have acquired beneficial ownership, for purposes of sections 13(d) and (g) of the Act, as of the date of such agreement, of all equity securities of that issuer beneficially owned by any such persons.” As revised, this rule would state: “When two or more persons act as a group under section 13(d)(3) of the Act, the group shall be deemed to have acquired beneficial ownership, for purposes of section 13(d) of the Act, of all equity securities of an issuer beneficially owned by any such persons as of the date of the group’s formation.” The proposed rule thus would untether group analysis from agreements to act for certain purposes. That is, the proposal is intended to make clear that the existence of a group does not depend solely upon whether the parties had an agreement to act together. However, the proposal provides scant further guidance on what constitutes acting as a group (other than to mention – without defining – formal or informal pooling arrangements). Although the Proposing Release does not describe this as a significant expansion of the group concept, without a doubt Section 16 plaintiffs will argue that such an expansion is exactly what the SEC sought to do here and use that expansion to create a larger pool of potential Section 16 defendants. The proposal would in fact represent a significant change as many courts have held that the existence of an agreement to act is a necessary predicate to existence of a group (and, indeed, for more than 40 years it appeared the SEC agreed).

- The Proposing Release would add new paragraph to Rule 13d-5(b) providing that, when a person who is or will be required to report on Schedule 13D discloses the non-public information that such a filing will be made with respect to an issuer, the disclosing person is deemed to have formed a group with the recipients to the extent such “information was shared with the purpose of causing such other person or persons to acquire” equity securities of such issuer. This provision is specifically targeted at alleged “wolf-pack” behavior whereby one investor tacitly signals other investors to join with it in building a position in an issuer by letting other potentially friendly investors know that it will soon be filing a Schedule 13D. Any person that files a Schedule 13D having shared such information will be required to file its Schedule 13D acknowledging the existence of a group and providing “other required disclosures as a group member.”

- The Proposing Release would also add certain exclusions from the new group rules (such as for intra-group transfers, for the entry into swap agreements in the ordinary course, and for certain activities not in connection with control activities).

Other Proposed Changes

The Proposed Rules will extend the EDGAR filing deadline for filings under Regulation 13D-G from 5:30 p.m. prevailing Eastern time on the last day for filing to 10:00 p.m. prevailing Eastern time. They will also require that all Schedule 13D and 13G disclosures (other than exhibits) would be structured in 13D/G-specific XML formats.

*****

Investors that file Schedule 13D or Schedule 13G should review this alert regarding SEC’s proposed rule changes. The capital markets, M&A and structured finance and securitization practices at Hunton Andrews Kurth LLP will continue to monitor the development of this rule-making and other Section 13 reporting matters. Please contact us if you have any questions or would like further information regarding the proposed rules or securities-based swaps, or require our assistance in submitting written comments on the proposed rules.

1 See, e.g., SEC Release No. 34-93784, December 15, 2021 (relating to swaps reporting); SEC Release No. IA-5955, February 9, 2022 (relating to certain disclosures by private funds); SEC Release No. 34-94313, February 25, 2022 (relating to short position reporting).

2 A control purpose means that the shares were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect. See Rule 13d-1(b)(1)(i), (c)(1).

3 Under the rules applicable to Schedule 13D (current and proposed), an increase or decrease of beneficial ownership by 1% or more is deemed to be material; however, that particular provision (Rule 13d-2(a)) is not applicable to Schedule 13G under current rules and the SEC has not proposed to make it applicable. Thus, practitioners will be left to consider what changes in ownership reported on Schedule 13G will be considered material and trigger an amendment and what other changes would be considered material. Presumably, general principles of materiality developed under the securities laws in other contexts will be applied unless and until the Commission or staff releases guidance to be applied in this area.

4 Under current Rule 13d‑3(d)(1)(i), a person is deemed to be the beneficial owner of any securities it has the right to acquire within 60 days.

5 Section 13(o) of the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2011) prohibited the SEC from regulating beneficial ownership of an equity security based on the purchase or sale of a “security-based swap” unless by rule and after consultation with the prudential regulators and the Secretary of the Treasury the SEC determines that (i) ownership of the swap provides incidents of ownership comparable to direct ownership of the underlying equity security and (ii) treating the purchase or sale of the swap as the acquisition of beneficial ownership of the underlying security is necessary to achieve the purposes of the pertinent provisions of the Exchange Act. Rather than adopting security-based swap regulation under Regulation 13D-G and making the required findings under Section 13(o), the SEC has limited the scope of its proposed revision of the beneficial ownership treatment of cash-settled derivatives to non-swap, non-futures instruments. As noted above, the SEC separately proposed security-based swaps reporting as an anti-fraud rule under Section 10B of the Exchange Act. See Hunton Andrews Kurth Client Alert, “Large Security-Based Swap Position Reporting.”