OFAC Implements Ban on Services related to Maritime Shipment of Russian Crude Oil

December 7, 2022

What Happened:

On November 22, 2022, the US Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) issued a determination pursuant to Executive Order 14071 prohibiting certain trading, financing, shipping, insurance, and other services (all “Covered Services” (as defined below)) from the United States – or by US persons wherever located – in connection with the maritime shipment of Russian crude oil that is purchased above a specified price (the “price cap”).1 This determination implements the US elements of the announcement in early September 2022 by the Group of Seven countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) (“G7”), the European Union (“EU”), and others of a ban on the importation of Russian-origin crude oil by those nations and the imposition of restrictions on services related to the maritime transportation of Russian-origin crude oil regardless of destination to the extent that the purchase price was above the price cap.2 The ban and price cap framework with respect to Russian-origin crude oil took effect on December 5, 2022. A similar ban and price cap framework with respect to the maritime transport of Russian-origin petroleum products is scheduled to go into effect on February 5, 2023.

The Bottom Line:

On December 2, 2022, an international coalition consisting of the G7 nations, the EU and Australia (collectively, the “Price Cap Coalition”) announced their respective adoptions of a price cap that would initially be set at $60.00 per barrel. On December 5, 2022, OFAC issued a further determination under EO 14071 formally adopting the Price Cap Coalition’s $60.00 per barrel cap.3On and after December 5, 2022, as a result of the two OFAC determinations relating to Russian-origin crude oil, the Price Cap Coalition’s agreement on a price cap, and other actions taken by participating nations:

- the maritime importation of Russian-origin crude oil to the Price Cap Coalition nations is generally prohibited;4 and

- the Price Cap Coalition nations have implemented or will be implementing prohibitions on the provision of Covered Services related to the maritime transportation of Russian-origin crude oil to countries that still permit the importation of such products where such crude oil is purchased at prices exceeding the price cap.

The Price Cap Coalition may amend the price in the future to reflect market developments and technical changes. The EU has stated that this review will take into account a variety of factors, which can include the effectiveness of the price cap framework, its implementation, international adherence and alignment, the potential impact on coalition members and partners, and market developments.

The G7 and Australia issued a statement regarding the adoption of the price cap which reads in part:

With this decision today, we deliver on the commitment of G7 Leaders at their summit in Elmau to prevent Russia from profiting from its war of aggression against Ukraine, to support stability in global energy markets and to minimise negative economic spillovers of Russia’s war of aggression, especially on low- and middle-income countries, who have felt the impacts of Putin’s war disproportionately.

To achieve these goals, G7 Finance Ministers on 2 September 2022 initiated a price cap on Russian-origin crude oil and petroleum products to be implemented by each coalition member. Our jurisdictions will prohibit services by our own providers which enable maritime transportation of Russian-origin crude oil and petroleum products globally – but with an exception for Russian-origin crude oil or petroleum products that are purchased at or below a specified maximum price.

The G7 statement also urged importing nations to take advantage of the price cap framework to demand discounts from Russia. At the current $60 level, the price cap is about 5% below the current market price for Russian-origin crude. Russia, for its part, has indicated that it “will not accept” a price cap on its oil and is considering how to respond.

The Full Story:

As noted above, on September 2, 2022, finance ministers from the G7 and the EU issued a statement confirming their joint intention to implement (1) a ban on importing into those nations Russian-origin crude oil (and, later, other petroleum products) and (2) a restriction on the provision of certain Covered Services related to the transportation of Russian-origin crude oil (and, later, other petroleum products) to other destinations to the extent the Russian-origin crude oil is purchased above a price cap determined by the Price Cap Coalition. Our prior discussion of this development and OFAC’s preliminary guidance on implementation of the price cap is available here: https://www.huntonak.com/en/insights/ofac-issues-preliminary-guidance-on-a-price-cap-for-russian-oil.html.

The import and Covered Services bans took effect on December 5, 2022. OFAC has issued a detailed memorandum that provides additional guidelines and information regarding the implementation of the price cap framework in the United States and as it relates to US persons.5

The import ban on Russian-origin crude oil will force a realignment of existing shipping routes. However, there is a global market for crude oil, maritime trade routes are flexible and can be adjusted, and a variety of countries that are not participating in the price cap framework could buy the Russian-origin oil that is no longer being sold in the Price Cap Coalition nations. Therefore, the participating countries imposed a further ban on persons in such countries providing Covered Services that are viewed as critical to Russia’s oil exports worldwide. Because the two bans together could cause global supply disruptions, price increases, and inflation, the Price Cap Coalition nations sought to mitigate these effects by combining the Covered Services ban with permission to provide these services for Russian oil purchased at or below the price cap. OFAC explained that the price cap was “intended to maintain a reliable supply of oil to the global market while reducing the revenues the Russian Federation earns from oil after its own war of choice in Ukraine inflated global energy prices.”

What are Covered Services?

OFAC’s November 2022 determination under EO 14071 specifically prohibits “the exportation, reexportation, sale, or supply, directly or indirectly, from the United States, or by a United States person, wherever located, of any of certain categories of services (collectively, the “Covered Services”) to any person located in the Russian Federation.” Covered Services comprise the following:

- Trading/commodities brokering: Buying, selling, or trading commodities and/or brokering the sale, purchase, or trade of commodities on behalf of other buyers or sellers.

- Financing: A commitment for the provision or disbursement of any debt, equity, funds, or economic resources, including grants, loans, guarantees, suretyships, bonds, letters of credit, supplier credits, buyer credits, and import or export advances.

- Shipping: Owning or operating a ship for the purpose of carrying or delivering cargo and/or freight transportation; chartering or sub-chartering ships to deliver cargo or transport freight; brokering between shipowners and charterers; and serving as a shipping/vessel agent.

- Insurance: The provision of insurance, reinsurance, or protection and indemnity (“P&I”) services; satisfying claims related to underwriting insurance policies that protect policyholders against losses that may occur as a result of property damage or liability; assuming all or part of the risk associated with existing insurance policies originally underwritten by other insurance carriers, including the reinsurance of a non-US insurance carrier by a US person; and liability insurance for maritime liability risks associated with the operation of a vessel, including cargo, hull, vessel, P&I, and charterer’s liability.

- Flagging: Registering or maintaining the registration of a vessel with a country’s national registry of vessels. This definition does not include the deflagging of vessels transporting Russian oil sold above the price cap.

- Customs brokering: Assisting importers and exporters in meeting requirements governing imports and exports. This definition does not include legal services or assisting importers and exporters in meeting the requirements of US sanctions.

Notwithstanding the foregoing prohibition, Covered Services relating to the maritime transportation of Russian-origin crude oil are permitted when the price of such product does not exceed the relevant price cap. OFAC’s guidance also indicates that US persons will be required to reject participation in any transaction to evade the price cap and report the transaction to OFAC. The coalition of countries participating in the price cap on Russian-origin oil are expected to mutually assist in the enforcement of the price cap and share information related to enforcement.

In addition, OFAC has provided guidance regarding specific fact patterns:

- The processing, clearing, or sending of payments by banks is not included in the definition of “financing” as a Covered Service where the bank (1) is operating solely as an intermediary and (2) does not have any direct relationship with the person providing services related to the maritime transport of the Russian oil (e., the person is a non-account party) as it relates to the transaction. The determination does not impose any new prohibitions or requirements related to the processing, clearing, or sending of payments by intermediary banks.

- Similarly, services with respect to foreign exchange transactions and the clearing of commodities futures contracts are outside the scope of “financing” as a Covered Service.

When Do the Restrictions Imposed by the Determination Start and End?

The price cap and related sanctions exclude Covered Services with respect to crude oil of Russian origin when such crude oil is loaded onto a vessel at the port of loading prior to 12:01 a.m. eastern standard time on December 5, 2022, and unloaded at the port of destination prior to 12:01 a.m. eastern standard time on January 19, 2023. OFAC, however, has provided little or no guidance to date as to how this would apply in practice. For example, a shipper could have loaded Russian-origin crude for shipment to India on December 1 at a price of $63.00 per barrel with a planned unloading in India on January 15, 2023. A US insurer might have provided the insurance coverage for this shipment. If, however, the planned unloading cannot be achieved due to a closure of the Suez Canal, this service would seem to be subject to the price cap framework and violate the US price cap implemented under EO 14071 even though the cargo was loaded before the price cap was set and even though the late delivery was due to no fault of the insurer.

According to the Guidance, the price cap applies from the loading for maritime transport of Russian-origin oil through the first landed sale in a jurisdiction other than Russia (through customs). However, if after landing and customs clearance, the crude is again shipped via water without being substantially transformed, the price cap again applies to any covered services. This means that US service providers will need to inquire about the source of crude oil being sold in foreign jurisdictions after December 5, 2022. Further, once Russian-origin crude oil is substantially transformed (e.g., refined or other substantial transformation) it is no longer considered to be of Russian origin.

What Is the “Safe Harbor” for Service Providers?

The Guidance describes a “safe harbor” for US persons as a defense against inadvertent OFAC violations. Although US sanctions are generally administered on a strict liability basis (with no exception for inadvertent violations), OFAC’s official guidance indicates a significant departure from this strict liability rule as it relates to the price cap framework: certain service providers that rely on attestations from other parties in the supply chain, that follow appropriate record-keeping and due diligence practices, and that inadvertently violate the price cap due to falsified records provided by bad faith actors seeking to cause a violation of or evade the price cap will not be subject to a sanctions enforcement action by OFAC.

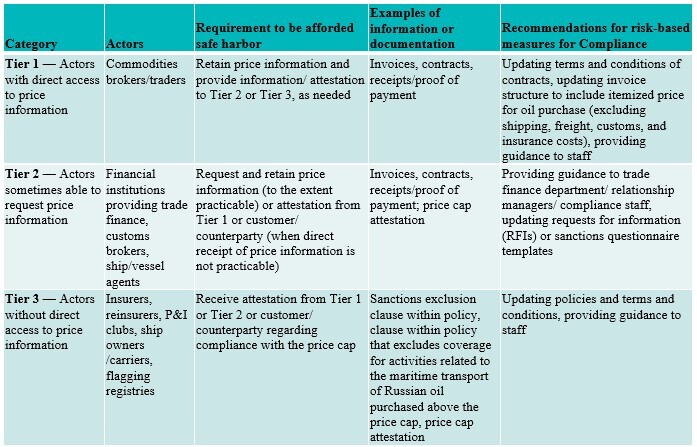

OFAC’s guidance sets forth a three-tiered approach to the safe harbor recordkeeping practices as shown in the chart below. OFAC requires that actors in all three tiers must keep records for five years. Service providers in Tier 2 and Tier 3 are also permitted to rely on attestations from other service providers. However, service providers in Tier 1 are not permitted to rely on attestations.

The Guidance also includes recommendations for obtaining the protection of the safe harbor for specific types of actors. For example, as to persons involved in the insurance side of the maritime oil trade, OFAC explains: “Insurers, reinsurers, and P&I clubs can be afforded the safe harbor through the use of sanctions exclusion clauses in policies or contracts, including pre-existing sanctions exclusion clauses. Alternatively, or in addition to sanctions exclusion clauses, these actors can be afforded the safe harbor through the use of clauses that exclude coverage for activities related to the maritime transport of Russian oil purchased above the price cap. These actors can also use signed attestations, should they so choose.” Additional specific recommendations for particular types of service providers can be found in the Guidance.

However, the safe harbor will not be available if the actor knew or had reason to know that the Russian-origin crude oil at issue was purchased above the price cap. As part of the safe harbor, OFAC expects that US service providers will perform the standard due diligence practices that are customary for their industry and for their role in a particular transaction. OFAC also expects that US service providers will be vigilant about red flags suggesting possible price cap evasion. Examples of these red flags were included in the preliminary guidance that OFAC offered shortly after the G7 group’s September announcement of the price cap framework.6 In its preliminary guidance, OFAC recommended that service providers be prepared to address red flags by institutionalizing sanctions compliance programs consistent with OFAC’s previously issued framework on sanctions compliance commitments, establishing automatic identification system (“AIS”) best practices and contractual requirements, monitoring ships throughout their entire transactions lifecycle, adopting Know Your Customer (“KYC”) and counterparty practices, exercising supply chain due diligence, incorporating best practices into contractual language, and fostering information sharing within the industry.

Conclusion:

With entry in effect of the price cap framework, the members of the Price Cap Coalition embark on a new and novel effort to impose economic costs on Russia for its invasion of Ukraine, while trying to carefully calibrate and limit the potential inflationary effects of this effort and hardships these new restrictions may cause.

Companies engaged in or providing services to the maritime shipping industry should carefully consider what effects the price cap framework and OFAC’s implementation guidance will have on existing sanctions compliance programs and customer due diligence processes.

# # #

Hunton Andrews Kurth LLP will continue to monitor closely the development of this and other US sanctions matters. Please contact us if you have any questions or would like further information regarding these new developments or other questions related to US sanctions programs.

1 OFAC, Prohibitions on Certain Services as They Relate to the Maritime Transport of Crude Oil of Russian Federation Origin, Nov. 22, 2022 (the “Determination”)

2 See G7 Germany 2022, G7 Finance Ministers’ Statement on the United Response to Russia’s War of Aggression Against Ukraine, Sept. 2, 2022. Immediately following the G7 ministers’ statement, OFAC issued its own preliminary guidance as it related to implementation in the United States. See OFAC, Preliminary Guidance on the Implementation of a Maritime Services Policy and Related Price Exception for Seaborne Russian Oil, Sept. 9, 2022.

3 OFAC, Determination pursuant to Executive Order 14071 related to a Price Cap on Crude Oil of Russian Federation Origin, Dec. 5, 2022.

4 Importation of Russian-origin oil and petroleum products was banned in the United States by EO 14066 (adopted in March 2022).

5 OFAC, OFAC Guidance on Implementation of the Price Cap Policy for Crude Oil of Russian Federation Origin, Nov. 22, 2022 (the “Guidance”).

6 See Hunton Andrews Kurth, OFAC Issues Preliminary Guidance on a Price Cap for Russian Oil, Sept. 14, 2022