Looking Beyond LIBOR — Observations on Interest Provisions in Risk-Free Rate Based Facility Agreements

November 11, 2020

On 27 July 2017, the Chief Executive of the UK Financial Conduct Authority (the “FCA”) announced that market participants should not rely on LIBOR being available after 2021. Earlier this year the FCA confirmed that notwithstanding the Coronavirus (COVID-19) outbreak, firms should continue to assume that LIBOR will not be available after 2021 and should plan accordingly. The timetable is tight for many market participants.

In line with the FCA position, the Working Group on Sterling Risk-Free Reference Rates1 (the “Sterling RFR Working Group”2) issued a recommendation that, after the end of Q3 2020, lenders should include clear contractual arrangements in all new and re-financed Sterling LIBOR-referencing loan products to facilitate conversion before the end of 2021, through pre-agreed conversion terms or an agreed process for renegotiation, to SONIA3 or other alternatives. Following this, on 11 September 2020, the Loan Market Association (the “LMA”) published the Rate Switch Agreement which is designed to constitute an inclusion of “pre-agreed conversion terms.” This switch mechanism constitutes a part of the LMA exposure draft4 of a multicurrency facility agreement. There are also LMA exposure drafts of a compounded SONIA based sterling term and revolving facilities agreement and a compounded SOFR5 based dollar term and revolving facilities agreement. The US Loan Syndications and Trading Association (the “LCTA”) has also released a draft SOFR Concept Credit Agreement and is seeking feedback from the US market in the same way as the LMA is on its exposure drafts. More recently, on 16 October 2020, the LMA published an updated list of syndicated and bilateral loans referencing near risk free rates.

The LMA list illustrates that there is a growing number of precedents of risk-free rate based loan agreements on the market. One of the most recent was entered into by Tesco PLC as borrower on 14 October 2020 (“Tesco Facility Agreement”). On the date of this note, this is the third publicly announced syndicated facility to reference RFRs, the first two being for Royal Dutch Shell plc and British American Tobacco PLC (the latter being signed on 12 March 2020 and examined in further detail below (the “BAT Facility Agreement”)).

In this note, we take a look at the precedents and examine some of the practical solutions offered by such instruments for drafting interest provisions in risk-free rate based loan agreements.

The Tesco Facility Agreement

The Tesco Facility Agreement is the first syndicated facility agreement that references both SONIA and SOFR from the signing date. The two previous RFR syndicated facility agreements, for Royal Dutch Shell plc and British American Tobacco, each referenced LIBOR on the signing date and contained a mechanism to switch to the RFRs during the life of the facility agreement. The Tesco Facility Agreement is also the world's first syndicated RFR facility agreement that provides a choice of interest periods. The other key features of the Tesco Facility Agreement as publicly available include the following:

- utilises a concept of a compounded interest in arrears (calculated using a daily non-cumulative compounded rate);

- includes a 5 banking day lookback period without observation shift, as recommended by the Sterling RFR Working Group. To clarify, such compounded rate is calculated based on the number of calendar days in an interest period. In other words, the applicable RFR for each day within a loan period is weighted based on the number of calendar days in the interest period. Then, the interest is calculated for the total number of calendar days in an interest period. In comparison with a lookback with observation shift, such approach is designed to avoid scenarios where the daily accrual may be negative. It is worth mentioning that the US Alternative Reference Rates Committee6 (the “ARRC”) also decided to adopt a lookback without observation shift where interest is calculated on compound in arrears basis. However, it was also determined that the basis risk between the two methods is minimal;

- the credit adjustment spread is fixed from the outset and based on an ISDA 5 year historical median approach as published on Bloomberg. This credit adjustment spread is designed to minimise the economic impact of moving from LIBOR to RFRs. In other words, it allows the parties to avoid a value transfer because LIBOR includes a bank credit risk component and reflects a variety of other factors (e.g. liquidity or fluctuations in supply and demand) which are not reflected in the RFRs. The choice of the basis is in line with the market preferences: in March 2020, Sterling RFR Working Group published the results of its consultation which showed a strong consensus in favour of a historical five-year median approach in line with the ISDA Historical Median Approach across both cessation and pre-cessation fallback triggers. In April 2020, the ARRC also recommended a credit adjustment spread methodology for cash products in line with the ISDA Historical Median Approach; and

- there is a zero floor calculated using an “Option 1” or RFR approach. At this moment, there are three main different options that have been considered in respect of managing for legacy LIBOR loans being converted to SONIA. Option 1 is recommended by the Sterling RFR Working Group and envisages that if SONIA plus the credit adjustment spread is less than the floor value, the credit adjustment spread remains unchanged and SONIA will be adjusted to ensure that SONIA plus the credit adjustment spread is equal to the floor. This approach has the benefit of being easy and simple to understand and implement. However, it requires the calculation/reconciliation of the compounded SONIA component using variable floors for each day in the interest period.

The BAT Facility Agreement

The BAT Facility Agreement is a syndicated facility which includes 21 banks, with Barclays as joint coordinator and HSBC as agent. From the comments made by British American Tobacco and HSBC following the execution of the facility agreement, it is apparent that some features of the BAT Facility Agreement derive from established relationships between the counterparties which enabled them to execute the transaction before RFR conventions had been settled.

As noted above, the BAT Facility Agreement provides that US and Sterling LIBOR applies from the signing date. At the same time, the BAT Facility Agreement incorporates the rate switch mechanism prescribing that the Benchmark Replacement Date7 which should occur for USD Advances and Sterling Advances on the first anniversary of the signing date. The BAT Facility Agreement also states that the Benchmark Replacement Date could be deferred by the Parent by serving a notice complying with the requirements as set out in the BAT Facility Agreement prior to the LIBOR Cessation.

The BAT Facility Agreement has a detailed definition of rate switch trigger event and includes ‘non-representativeness’ as well as cessation triggers. The triggers are broadly aligned with the triggers set out in the ARRC’s fallback wording. In this context, it is worth mentioning that very recently the LMA published a “Note on Revised Replacement of Screen Rate Clause and pre-cessation trigger” which sets out the considerations behind the inclusion of such specific pre-cessation trigger relating to a benchmark rate no longer being representative. In light of the publication of Amendments to the 2006 ISDA Definitions to include new fallbacks, adding a non-representativeness pre-cessation trigger is even more important where, in due course, related derivatives transactions may include such a trigger following the ISDA IBOR Fallbacks Supplement becoming effective on 25 January 2021.

Under the BAT Facility Agreement, provided that the LIBOR Cessation occurs prior to the Benchmark Replacement Date as stipulated (including, any Benchmark Replacement Date as deferred by the Parent), the Agent is obliged to give notice to the Parent and the Banks to confirm (1) the occurrence of the LIBOR Cessation and (2) the Benchmark Replacement Date. Such Benchmark Replacement Date could only fall on a Business Day and should coincide with the date of the notice. It appears that the relevant provisions of the BAT Facility Agreement are based on the assumption that LIBOR shall continue to be available for some period of time after any event constituting the LIBOR Cessation has occurred. This is required to ensure that LIBOR is available until the Agent is able to issue its notice to set up the Benchmark Replacement Date. Only after such notice is issued, do the Adjusted Reference Rates start to apply to Advances in USD and Sterling. Of course, in practice, the Agent is expected to issue such a notice immediately after LIBOR Cessation so the period between LIBOR Cessation and the Benchmark Replacement Date should be very limited.

The BAT Facility Agreement contains two definitions of the Adjusted Reference Rates, one for US Dollars and one for Sterling. The US$ Adjusted Reference Rate is defined as the aggregate of the applicable US$ Reference Rate and US$ RR Adjustment Rate with a zero floor.

The first component is a US$ Reference Rate which is defined as follows:

““US$ Reference Rate” means, in relation to any Advance denominated in US Dollars:

(a) the US$ Primary Screen Rate (if any) for the US$ Observation Period relating to the Term of that Advance; or

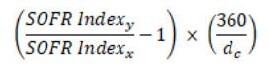

(b) if there is no US$ Primary Screen Rate, or if no US$ Primary Screen Rate is available for the US$ Observation Period relating to the Term of that Advance, the applicable US$ Reference Rate shall be the rate calculated by the Agent (rounded if necessary to five decimal places with 0.000005 being rounded upwards) which results from applying the formula set out below:

where:

x is the rate provided by the SOFR Index that is applicable to the first day of the US$ Observation Period relating to the Term of that Advance;

y is the rate provided by the SOFR Index that is applicable to the final day of the US$ Observation Period relating to the Term of that Advance; and

dc has the meaning given to it in the definition of “US$ Fallback Compounded Rate” at Schedule 10 (US$ Reference Rate - Definitions); or

(c) if there is no SOFR Index, or if no SOFR Index is available for the US$ Observation Period relating to the Term of that Advance, the applicable US$ Reference Rate shall be the US$ Fallback Compounded Rate for that Advance.”

The BAT Facility Agreement uses a lookback with an observation shift mechanism. The US$ Observation Period for the interest rate calculation starts and ends a certain number of days prior to the interest period. As a result, the interest payment can be calculated prior to the end of the interest period. In the BAT Facility Agreement, the lookback period is 5 Business Days and it includes the date that is 5 US Banking Days prior to the first day of the relevant Term and ends on but excludes the date that is 5 US Banking Days prior to the last day of that Term. As noted, a 5 Business Days lookback is in line with market convention. However, in comparison with the Tesco Facility Agreement, the BAT Facility Agreement incorporates the observation shift concept. In other words, the compounded rate is calculated based on the number of calendar days in an observation period which means that the applicable RFR for each day within a loan period is weighted based on the number of calendar days in the observation period. Interest is calculated for the total number of calendar days in an interest period. With such an approach, if the RFR were to reduce sharply around bank holidays there could be a negative accrual on certain days (even if the RFR is not negative). However, total interest for that interest period will not be negative. Applying an observation shift is designed to match overnight indexed swap contracts. The SOFR Index and SONIA Index which are referred to in the BAT Facility Agreement envisage an observation shift.

As an aside, British American Tobacco commented that in the context of RFRs, to the parties’ surprise, negotiations on the definition of “Business Days” were much more complicated than anticipated. The pragmatic solution reached by the counterparties was to draft the relevant provisions based on the locus of the currency and the relevant agent.

The BAT Facility Agreement provides that the US$ Primary Screen Rate should be publicly available and use the compounding methodology which is the same as that specified in the BAT Facility Agreement for the US$ Fallback Compounded Rate. The relevant screen rate could be designated as US$ Primary Screen Rate by the Agent acting on the instructions of the Majority Banks and the Parent. Note that there is currently no Primary Screen Rate published.

As noted above, the BAT Facility Agreement includes references to the SOFR Index. The Federal Reserve Bank of New York began publishing a SOFR Index on 2 March 2020. The SOFR Index measures the cumulative impact of compounding SOFR on a unit of investment over time and is published on its website shortly after SOFR is published at 08:00 (Eastern Standard Time). The SOFR Index employs daily compounding on business days, as determined by the SOFR publication calendar and simple interest will apply to any day that is not a business day, at a rate of interest equal to the SOFR value for the preceding day. Needless to say, referencing an index in the facility agreement makes calculation of the compounded rate significantly simpler. However, a calculation of the compounded SOFR will still need to be made in order to apply the index data to the relevant period. It is worth pointing out that a similar concept is used in the BAT Facility Agreement with respect to the Sterling Reference Rate. The Bank of England started publishing SONIA Index from 3 August 2020 and the methodology for the SONIA Index is consistent with the approach taken by the Federal Reserve Bank of New York.

The final element in the formula is dc which is defined as the number of calendar days in the relevant US$ Observation Period.

The BAT Facility Agreement also provides a formula for the calculation of the US$ Fallback Compounded Rate with all relevant definitions and explanations for components of the formula. In contrast, the exposure drafts currently published by the LMA do not include the compounding formula for the fallback compounding rate. Accordingly, the BAT Facility Agreement may prove to be a very useful starting point for parties who would like to include fallback formula in their loan documentation.

The final component of the US$ Adjusted Reference Rate is the US$ RR Adjustment Spread. The BAT Facility Agreement provides for 0.10 per cent per annum. Given that the calculation was performed and the percentage agreed upfront (rather than when the switch from LIBOR to the RFR is triggered) all parties benefited from clarity at the time the document was agreed. The Advances in Sterling in the BAT Facility Agreement are treated in the same way.

Finally, it is worth noting how the BAT Facility Agreement deals with the issue of breakage cost. It only requires breakage costs to be paid with respect to voluntary prepayments if they are made prior to the Benchmark Replacement Date. Following the Benchmark Replacement Date, the BAT Facility Agreement only limits how often the Borrowers are allowed to prepay the Advances. As explained by the working team involved in drafting the BAT Facility Agreement, this was a pragmatic solution to mitigate the administrative burden associated with prepayments on the assumption that the economic costs (if any) for the lenders are de minimis.

We noted at the outset that many borrowers and lenders are facing tight deadlines to become fully operational in the new RFR environment, whether by dealing with legacy loan instruments, entering into new loan instruments or by a combination of the two. The complexity and novelty of the issues, the volume of information and the numerous variables involved may appear overwhelming. In this note, we have looked at some practical solutions and some valuable starting points for market participants to consider when drafting interest provisions in RFR based facility agreements.

Notes:

Unless stated otherwise, the definitions set out in the footnotes to this document have been extracted from the Glossary of Terms relating to LIBOR transition published by the Loan Market Association on 29 May 2020.

1 Risk-Free Rates (“RFRs”) have been identified by national working groups as alternatives to Interbank Offered Rates, such as LIBOR. The RFRs chosen are overnight risk-free (or near risk-free) rates measured from transactions in interbank unsecured lending markets or Repo markets.

2 The Sterling RFR Working Group is a group of private-market participants convened by the Bank of England in 2015 in response to the Financial Stability Board’s 2014 report on interest rate benchmark reform, to help ensure a successful transition from Sterling LIBOR to a more robust reference rate, its recommended alternative, SONIA.

3 The Sterling Overnight Index Average (“SONIA”) is administered by the Bank of England and measures the rate at which interest is paid on sterling short-term wholesale funds in circumstances where credit, liquidity and other risks are minimal.

4 Exposure drafts constitute documentation published by the LMA in respect of LIBOR transition which is open for comments from market participants.

5 The Secured Overnight Financing Rate (“SOFR”) is produced by the Federal Reserve Bank of New York and is a secured risk-free rate which measures the broad cost of borrowing US dollar sums overnight collateralised by US Treasury securities and is calculated by reference to the transactions executed in the overnight US Government securities Repo market.

6 The US Alternative Reference Rates Committee is a group of private market participants convened by the Federal Reserve Board and the Federal Reserve Bank of New York in 2014 to help ensure a successful transition from USD LIBOR to a more robust reference rate, its recommended alternative, SOFR.

7 All capitalised terms under the sub-heading, “BAT Facility Agreement,” unless otherwise defined in this note or the context otherwise requires, have the same meaning as given to them in the BAT Facility Agreement.