It’s Time for Term SOFR (for Some)

August 3, 2021

The Alternative Reference Rates Committee (ARRC) has formally recommended CME Group’s forward-looking term SOFR for use in:

- legacy contracts with ARRC-recommended fallback language, including LIBOR-based

- floating rate notes,

- bilateral and syndicated business loans,

- securitizations,

- residential adjustable-rate mortgage loans, and

- private student loans;

- new contracts for business loans and securitizations of term SOFR assets; and

- derivatives for end-users who need to hedge term SOFR cash products.

For everything else, the choice of SOFR methodologies—simple or compounded, in advance or arrears—remains the same.

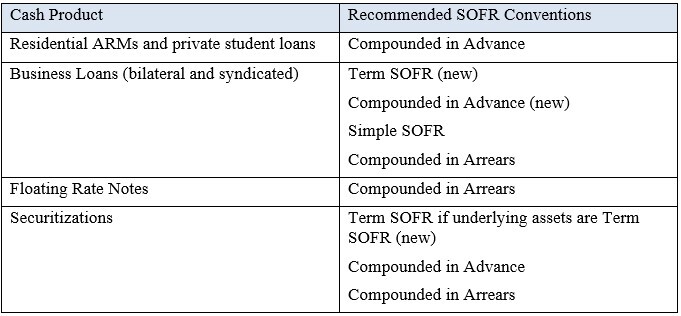

The ARRC’s recommended SOFR conventions for new cash products now include:

Federal LIBOR Legislation

The states of New York and Alabama jumped ahead to address their LIBOR problems with LIBOR legislation that effectively implements the ARRC’s recommended replacements in state-law governed contracts that cannot be amended before LIBOR’s end and provides a safe harbor to those who choose to implement the ARRC’s recommended replacements. Congress may soon catch-up. Last week, the House Committee on Financial Services voted in favor of passing the Adjustable Interest Rate (LIBOR) Act of 2021 (H.R. 4616), which provides similar protections, but also addresses matters that can only be addressed at the Federal level—like the Trust Indenture Act. Much legislative grinding remains.

Hunton Andrews Kurth’s multi-disciplinary LIBOR transition client service team is available to assist clients navigating this crucial transition. For further information, contact Tina Locatelli or Amy McDaniel Williams.