CFIUS Releases 2022 Annual Report

August 10, 2023

What Happened:

On July 31, 2023, the Committee on Foreign Investment in the United States (CFIUS) released its annual report for calendar year 2022 (the Report). The Report provides to the public the second full year of data regarding CFIUS activities since the implementation of the 2020 rule changes mandated by the Foreign Investment Risk Review Modernization Act (FIRRMA) and discloses a number of trends and developments regarding CFIUS review of foreign investment in the United States.

The Bottom Line:

The Report provides key insights for Companies considering transactions within CFIUS’s jurisdiction, including:

- CFIUS review times were longer on average in 2022. Clearance rates for declarations declined in 2022, with a greater number of declarations resulting in a request from CFIUS to file a longer-form notice, and the number of notices for which CFIUS requested that the parties re-file was up slightly in 2022 from prior years.

- CFIUS appears to be requesting mitigation agreements in more cases. The 2022 data is consistent with anecdotal reports that mitigation agreements are being requested in transactions where practitioners had not previously seen them.

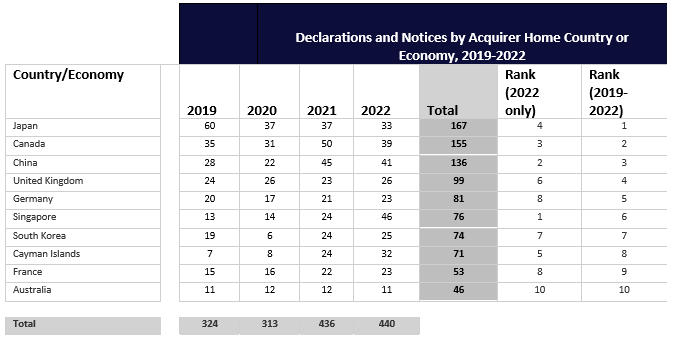

- Filers from the ten most common countries of origin are increasingly responsible for the majority of filings (approximately 68% in 2022). Singapore ranked 1st as country of origin in 2022, as the number of filers from that country grew substantially.

- CFIUS practitioners and stakeholders were provided insights through key actions in 2022: increased public engagement from CFIUS, the publication of enforcement and penalties guidance by the US Department of Treasury (Treasury), and Executive Order 14083, which directed CFIUS to consider certain factors in its reviews.

We discuss these highlights further below.

The Full Story:

Declarations

There were 154 declarations filed in 2022 compared with 164 declarations filed in 2021 and 126 declarations filed in 2020, representing a modest decrease in the number of declarations filed year-over-year for 2022. Approximately 58% of cases notified by declaration in 2022 were cleared by CFIUS (compared with 73% and 64% in 2021 and 2020 respectively). In 2022, CFIUS directed the parties to a declaration to make a notice filing in 32% of cases (a substantial increase relative to 18% and 22% for 2021 and 2020 respectively).

These trends show that declarations cleared at lower rates and resulted in a request for a notice filing in more cases than in 2021. The numbers suggest that the growing acceptance of the declaration process on both the part of CFIUS and filers may have reached a limit as a greater number of declarations are directed towards CFIUS’s notice process. It is not immediately clear why a greater number of declarations resulted in requests for notice filings in 2022. The decision of whether to file a declaration or a notice remains a key issue in considering a CFIUS filing.

The top five filers of declarations in 2022 by country of origin were unchanged from 2021 – Canada (22), Germany (13), Japan (18), Singapore (9) France (9), and South Korea (11) – and accounted for 82 of the year’s declaration filings (or over 53%). This reflects a continued concentration of declaration filings among filers from countries of origin that are traditional allies of the United States.

In contrast, filers from China (a major country of origin for foreign investment in the United States) continue to use the notice process over declarations. Filers from China filed five declarations in 2022, up from one declaration in 2021 (while ranking 1st and 2nd for notices in 2021 and 2022 respectively).

Notices

There were 286 notices filed in 2022 compared with 272 notices filed in 2021 and 187 notices filed in 2020. As was the case in 2021, a substantial number of notices were withdrawn and re-filed in 2022. In 2022, of the 286 notices filed, 88 were withdrawn, and in 68 such instances the notices were subsequently refiled (53 were refiled in 2022 and 15 were refiled in 2023). By contrast, of the 272 notices filed in 2021, 74 were withdrawn, and in 63 such instances the notices were subsequently re-filed (52 in 2021 and 11 in 2022). The Report does not provide the number of “unique” filings each year. Thus, it is possible that the reported 286 notice filings in 2022 really reflect 218 distinct cases.

The slight uptick in notice filings, along with a commensurate drop in declaration filings, suggests that the number of transactions filed with CFIUS remained relatively stable from 2021 to 2022. This is remarkable given the substantial slow-down in overall foreign direct investment activity over the same period—the US Bureau of Economic Statistics estimates that expenditures by foreign investors to acquire, establish, or expand US businesses totaled $177.5 billion in 2022, down $185.1 billion from $362.6 billion in 2021. This context suggests that CFIUS reviewed a greater proportion of foreign investment in the United States in 2022 than in 2021.

According to the Report, there were 20 instances in 2022 in which the parties abandoned the transaction after withdrawal (compared with 11 instances in 2021); of those, CFIUS reports that 12 occurred because CFIUS was unable to identify mitigation measures that would resolve identified national security risks or because the mitigation measures requested by CFIUS proved unacceptable to the parties; the other eight were abandoned by the parties for commercial reasons.

CFIUS reports that it requested a greater number of identified non-notified covered transactions file notices in 2022 (13% of 84 transactions that were identified and put forward to CFIUS for further consideration) than in 2021 (6% of 135 such transactions). It is hard to draw any inferences from this change, however, because CFIUS noted that it is continuing to clear a backlog. It is important to note that the reportable number of potential non-notified transactions identified by CFIUS for 2022 does not reflect instances where the parties decided to voluntarily file after receiving a non-notified-related communication from CFIUS (but prior to a formal request) nor does it reflect non-notified transactions considered by individual member agencies.

Of the 286 notices of covered transaction in 2022, CFIUS initiated the second 45-day “investigation” period following an initial 45-day review period with respect to 162 (56%). By contrast, in 2021, CFIUS initiated the “investigation” period with respect to 130 of 272 notices (48%). In addition, the average number of calendar days for obtaining clearance in the investigation period increased from 65 days in 2021 to 80.5 days in 2022. The upshot is that more notices went into the investigation period, and took longer to clear, than in prior years. Whether this marks a trend towards longer CFIUS reviews remains to be seen.

Geographic and Sectoral Distribution

For looking at the geographical and sectoral distribution of CFIUS filings, it may be more useful if declarations and notices are combined. Such combination looks at overall demand for CFIUS review from various countries and regions and for various sectors (distorted by the fact that approximately 32% of declaration filers were asked to file a full notice in 2022). A table setting forth this information is set forth below.

Almost no matter how the filings are sorted and ranked, for 2019-2021, Canada, China and Japan occupied the top three spots for frequency of filings of declarations and notices. In 2022, however, the number of filings from Singapore jumped dramatically (by over 90%) to put it in 1st place for filings – ahead of Canada, China and Japan; Singapore origin filings focused on the US finance, information, and services sectors. This appears as part of a longer trend of increasing filing activity from Singapore, South Korea, and the Cayman Islands. Another trend worth noting is that the top ten acquirer home countries (reflected in the table above) continue to be responsible for a greater proportion of total filings: in 2020, 60% of filings came from the countries listed above, compared to 65% in 2021 and 68% in 2022.

Among US business sectors seeing the most covered transaction filings in 2022, the scientific research, power, and software sectors saw the most activity. Filers submitted 15 declarations and 26 notices for covered transactions in US software publishing firms group (by four-digit NAICS code designation). Filers submitted 15 declarations and 24 notices for covered transactions in US businesses in the electric power generation, transmission, and distribution industry group, and covered transactions involving US scientific research and development services were the subject of 8 declarations and 20 notices.

Critical Technologies

In 2022, CFIUS reviewed 181 covered transactions involving the acquisition of US critical technology businesses, down slightly from 184 critical technology covered transactions in 2021. In contrast, in 2020 CFIUS reviewed 122 critical technology acquisitions and in 2019 it reviewed only 92. Of the 181 critical technology covered transactions in 2022, most filers hailed from Japan (16), France (14), Canada (13), the United Kingdom (13), and South Korea (12). By far, the largest number of notices filed involved acquisition of US businesses in the machinery manufacturing sector with 84 filings (compared with 36 filings involving acquisitions in the telecommunications sector and 34 filings involving acquisitions in the professional, scientific, and technical services). Despite the significant focus in this area, the Report notes that CFIUS considered acquisitions of critical technologies across all industries, including looking at past acquisitions as appropriate.

Mitigation

In 2022, CFIUS cleared 41 notices of covered transactions after adopting agreements to resolve national security concerns —approximately 23% of distinct 2022 notices. By contrast, of the 272 notices filed in 2021, CFIUS cleared 26 (just under 10%) with mitigation. The significant increase in the number of national security agreement requests from CFIUS supports anecdotal observations from our team and other CFIUS practitioners that CFIUS is requesting mitigation in more circumstances than in prior years (our practice note describing this observation is available here). Typically, where national security agreements are required by CFIUS, the parties to such transactions recognize well before notices or declarations are filed that the transaction at issue may require mitigation commitments to be made before CFIUS will clear the transaction. While the need for mitigation is determined on a case-by-case basis, the trend towards more national security agreements may signal a lower threshold at CFIUS for requiring mitigation than prevailed in the past.

Real Estate Transactions

Filers continued to make a limited number of real estate filings made under CFIUS’s part 802 rules in 2022: five declarations and one notice were filed for real estate transactions under the part 802 rules. In 2021, filers submitted one declaration and six notices for real estate transactions. These numbers are far short of CFIUS’s 2020 projections under its proposed FIRRMA regulations of 150 real estate notices per year and 200 real estate declarations per year. It is not immediately clear why real estate filings fell so far short of CFIUS estimates as foreign investment in US real estate remained strong 2020 through 2022.

Important Developments

The Report highlights a number of other important developments over calendar year 2022 that are relevant to stakeholders. In 2022:

- CFIUS identified New Zealand as an “excepted foreign state” and determined that Australia and Canada will remain “excepted foreign states” under CFIUS’s part 800 rules. All four “Five Eyes” allies of the United States (e.g., Australia, Canada, New Zealand, and the United Kingdom) now have “excepted foreign state” status under the part 800 rules. Certain qualifying investors from those countries are exempt from CFIUS jurisdiction over certain non-control transactions that would otherwise be covered transactions.

- On September 15, 2022, President Biden issued an Executive Order 14083 that elaborates on existing national security factors that CFIUS should consider in its reviews. EO 14083 specifically directs CFIUS to consider certain priority technologies and sectors as particularly sensitive, directs CFIUS to consider a covered transaction’s effect on supply chain resilience, and emphasizes that the Committee should carefully consider three factors in its review of covered transactions: aggregate industry investment trends, cybersecurity capabilities and practice, and risks to sensitive personal data. Our coverage of EO 14083 is available here.

- CFIUS increased its engagement with the public through two noteworthy actions: (1) Treasury held an inaugural CFIUS conference in June 2022, which provided a platform for CFIUS members and staff to engage with stakeholders on the CFIUS process, how CFIUS assesses risks, and other topics relevant to CFIUS specialists; and (2) in October 2022, CFIUS released its first enforcement and penalty guidelines for how CFIUS will assess violations of mandatory filing requirements and breaches of national security agreements with CFIUS.

- CFIUS continued to increase staff and build dedicated internal teams for non-notified/non-declared transactions, monitoring and enforcement, international collaboration, and investment security policy. In addition to increasing the number of case officers dedicated to reviews and investigations of covered transactions, in 2022, Treasury began hiring technical experts in specific disciplines, such as cybersecurity, natural and formal sciences, and enforcement. Whether this effort will result in shorter clearance times for filers remains to be seen.

*****

The national security, mergers and acquisitions, private equity and competition practices at Hunton Andrews Kurth LLP will continue to monitor the development of this rulemaking and other CFIUS and cross-border investment matters. Please contact us if you have any questions or would like further information regarding CFIUS or require our assistance in considering what CFIUS’s 2022 Annual Report may mean for your transaction.